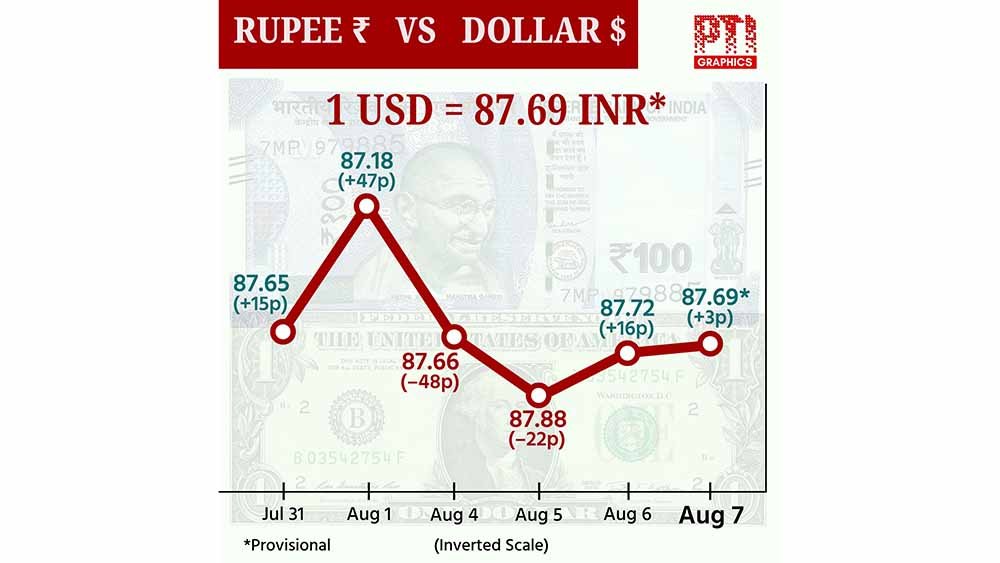

The rupee consolidated in a narrow range and settled for the day higher by just 3 paise at 87.69 (provisional) against the US dollar on Thursday, after US President Donald Trump slapped an additional 25% duty — doubling it to 50% — on Indian goods, denting market sentiments.

Forex traders said weak crude oil prices and a decline in the US Dollar index supported the rupee. However, muted domestic markets and foreign fund outflows capped sharp gains.

Moreover, Trump’s aggressive move, which kicks in 21 days, threatens to raise total duties on select Indian exports to as high as 50% — making them among the most heavily taxed US imports globally, further dented market sentiments.

At the interbank foreign exchange, the domestic unit opened at 87.69 and moved in a range of 87.67-87.77 during the day before settling at 87.69 (provisional), rising 3 paise from its previous close.

On Wednesday, the rupee rebounded from a record low level and closed 16 paise higher at 87.72 against the US dollar.

Trump’s tariffs on Indian exports are likely to hit sectors such as textiles, marine and leather exports hard and was slammed by India as “unfair, unjustified and unreasonable”.

With this action singling out New Delhi for the Russian oil imports, India will attract the highest US tariff of 50% along with Brazil.

The United States has imposed this additional tariff or penalty for Russian imports only on India while other buyers such as China and Turkey have so far escaped such harsh measures. The 30% tariff on China and 15% on Turkey is lower than India’s 50%.

“We expect the rupee to slide as the trade tariff deal continues to linger with US President Donald Trump doubling tariff on India to 50%, denting market sentiments. A weak tone in the domestic equities and selling by foreign investors may also pressurise the rupee. “However, weakness in the US dollar and falling global oil prices may support the rupee at lower levels. USD-INR spot price is expected to trade in a range of 87.50 to 88,” Anuj Choudhary – Research Analyst, commodities and currencies, Mirae Asset Sharekhan.

Meanwhile, the Reserve Bank of India (RBI) on Wednesday decided to keep policy rate unchanged at 5.5% and retained the neutral stance, amid concerns over tariff uncertainties.

Announcing the third bi-monthly monetary policy of the current fiscal, RBI Governor Sanjay Malhotra said the growth rate projection for FY26 has been retained at 6.5%.

Meanwhile, Brent crude prices rose 0.52% to USD 67.24 per barrel in futures trade.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.10% to 98.08.

In the domestic equity market, the Sensex advanced 79.27 points to settle at 80,623.26, while Nifty was up 21.95 points to 24,596.15.

Foreign institutional investors (FIIs) offloaded equities worth Rs 4,999.10 crore on a net basis on Wednesday, according to exchange data.

Rupee rises 3 paise to closeat 87.69 against US dollar

MUMBAI, AUG 7 (PTI)